Understanding the Effects of Behavioral Finance on Investing

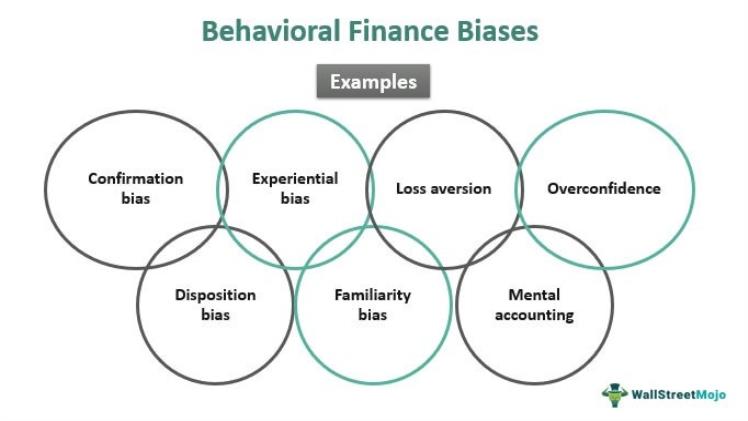

Behavioral Finance is a branch of economics and finance that uses psychology to investigate why people make financial decisions that don’t conform to traditional models. It examines anomalies like why even experienced investors buy too late and sell too soon or why someone doesn’t use their savings account for paying off large credit card debt.

Finance theory typically assumes people are rational and have unbiased expectations of the future. However, behavioral finance suggests this may not be true and suggests people make irrational financial decisions due to personal biases.

Understanding how bias and emotions impact investing is a helpful tool in aiding your clients in taking stock of the bigger picture. Utilizing these insights to guide them toward evidence-based investment decisions will increase their chances of achieving their objectives, as well as save more for the future.

Herd Instinct

Studies conducted by psychologist Daniel Kahneman and other researchers have revealed that people often rely on herd instinct as a shortcut when making decisions. This heuristic (mental shortcut) may lead investors to make hasty, risky investments that don’t meet their own expectations or goals.

Gain Aversion and Loss Aversion

Studies have revealed that people value gains over losses differently. While they might take a risk with a 50% chance of winning, they tend to avoid options where there is a 100% likelihood of failure – this behavior is known as loss aversion, and it’s one of the most prevalent cognitive biases in finance.

Many investors make poor investment decisions. This can lead to irrational behavior which negatively impacts the overall market.

Please visit for more information: Movierulz Page

Behavioral finance theories have been used to explain significant market anomalies, such as the Internet bubble and deep recessions. Furthermore, behavioral finance demonstrates that markets are not fully efficient; stock prices can be affected by factors outside traditional economic analysis.

Herd Instinct

Investors often follow the herd when it comes to stock prices, often buying in bull markets and selling during bear ones. This can be difficult for novices to comprehend, but can provide helpful insight when analyzing market returns in hindsight as it provides insight into what’s driving these price changes.

Herd Instinct can also be a factor in why some people have been more successful on the stock market than others. By understanding your client’s heuristics, it will become easier to detect when they are making an investment mistake.

Gain Aversion and Loss Aptitude

If you’re new to the investment world, it may seem like making a quick profit on one stock is more valuable than taking a larger loss with another one. However, behavioral finance explains this as being due to risk aversion and loss aversion; thus, it is beneficial to recognize and overcome these biases.

By acknowledging and overcoming your own behavioral biases, you can make more informed, evidence-driven investment decisions for the benefit of your clients. Gaining insight into yourself allows for the creation of more diversified portfolios with improved diversification strategies.

To know more different types of news like – Erratichour, Dramasto, Homedesign, Healthyfood, Fotolog, Casinoplay, Healthydiett, Weddingmedia